(Note: This story appears in the November 2022 issue of ED Magazine)

Cash remains king in the multi-billion-dollar adult nightclub industry, which means that ATM machines and other money-related products are as important as ever.

But are club owners & operators aware of the latest technology — and why they should consider upgrading theirs today?

This ED Magazine Special Focus is highlighting not only the top companies but also the latest technological advancements that they may be missing out on.

What is your most popular product?

Club Control Systems

Club Control Systemsclubcontrolsys.comThe Onyx-W ATM. The Onyx-W can be installed securely as a wall mount or on a counter top. Your installation options are only limited by your imagination. Featuring a high- resolution 10.1” LCD screen and light-up touch function keys along with 2” receipt printer, the Onyx-W uses the same modules and software capabilities and functions found in existing Genmega ATMs. Dispensing is handled via a 1000-note removable cassette which is secured inside it’s own internal vault system which is available with electronic locks.

BanQone

banqone.com

Although we sell traditional ATM services and credit card point of sale equipment, we are best known for our patent pending nightlife ATM called The Rain Maker Kiosk.

Star Financial

Star Financial

gowithstar.com

Our most popular product is the Genmega C6000 ATM machine. The Genmega C6000 ATM includes high-end features including a 15” LCD with function key or 15” touch screen LCD and 2K cassette, eye-catching modern design and a host of hardware options driven by a Microsoft Windows CE 6.0 operating environment for maximum flexibility.

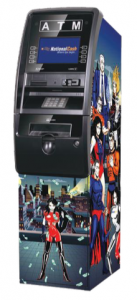

National Cash

nationalcash.com

nationalcash.com

Because of their dedication to building reliable state of the art equipment, we favor Onyx by Genmega. With sleek retail stand alone, or wall mounted options and an extra-large screen, its financial and professional aesthetic encourages transactions. And with the technology Genmega provides, the screen can host full-motion videos for advertising, bringing in more customers and advertising space for additional revenue.

Filler Up Financial Services

Filler Up Financial Services

fillerupfinancial.com

Definitely a favorite of our clubs is the Nautilus Hyosung MX 2800 or Force. It features a nice 12-inch screen as well as an integrated topper that allows you to control the brightness, which is a big plus for the nightlife industry. Another industry specific feature is the lights inside the bottom of the safe. This allows the service provider to never need a flashlight to load or service the ATM, speeding up the time to service each ATM.

What features does this product possess that separate it from similar cash-dispensing or cash-related products?

BanQone

The Rain Maker allows patrons to withdraw up to $1,000 and get a portion in $1 bills. The same kiosk also allows patrons to break large bills into $1 bills in seconds while creating a new revenue stream for club owners. Less time waiting to make change and more time spending money means a win-win for patrons and staff alike.

Filler Up Financial Services

Every year club owners are looking for the next thing in the ATM industry and since our inception the ATM hasn’t seen much improvement aside from the bigger screens and PC-based mainboards. What sets an ATM apart from another is how they are utilizing the features that it comes with.

Our ability to add custom graphics to the ATM screen allows the clubs to add marketing messages that scroll as the ATM sits idle. This can allow for the club to promote a certain product or feature images of their entertainers.

Many credit cards allow the cardholder to take a cash advance against their credit limit using a PIN issued by a bank or financial institution. A cash advance can also be taken at an ATM with a credit card; however, there are fees and bank charges associated with such transactions.

Credit card segmentation (CCS) is an additional revenue-generating feature that allows the ATM to charge an additional incremental fee for a credit card cash withdrawal transaction. CCS is only enabled on the ATM with a certified software at a processor level. CCS increases customer base and satisfaction, allowing ATM operators to generate an additional income per CCS transaction on top of the surcharge income. Offering credit card cash advance features on the ATM expands ATM operators’ customer reach and boosts the money to the floor.

National Cash

With a bright 10.2” wide screen LCD and touch keys, the Onyx was made with an eye on the future. The Onyx is ready for Apple Pay and Google Pay (coming in 2023), able to handle cardless applications, and full-motion video advertising. The Onyx leverages the latest technology without disrupting the basic function of dispensing cash. With all that functionality in this small machine, there’s also the impressive capacity to hold up to four 2,000 note dispensers. If a site is interested in using digital wallets, purchasing cryptocurrency, or converting to a patron’s home currency, the Onxy is ready to go for all of that as well. National Cash works directly with Genmega to stay on top of the latest tech and trends to bring them directly to our clubs.

Star Financial

The Genmega C6000 can dispense denominations as small as $1 or $5. The machine also offers four trays that can fit up to 2,000 bills so you won’t constantly be running out of money. The ATM also has camera functionality available which can help reduce fraud. Our ATM can also accept Bitcoin. Lastly, we can set up the ATM fee to be a flat dollar amount and/or percentage fee structure.

For those clubs who have not ‘modernized’ their ATMs, what new technology should they be aware of and why should they upgrade?

BanQone

The Rain Maker Kiosk saves time and creates new revenue streams by putting single dollar bills in your patrons’ hands quickly and automatically. Since it was created for the industry, we believe it is the best cash related solution currently available. Our kiosk has the capacity of roughly 12 traditional ATM machines.

Club Control Systems

PCI is mandating updated keypads on ATMs by 2024. This would impact most ATM built before 2014, requiring new keypad (EPP) and updating software. I would speak with your ATM company for more details.

Warren Cato is a founder of Pocketbook, Inc, a new network that will soon allow consumers with funds in a digital wallet (e.g. PayPal, rebate companies, sportsbook companies, etc) to access cash from an ATM with Pocketbook software on it.

National Cash

The financial industry is constantly updating requirements, and manufacturers are constantly updating equipment and software. That’s why it’s imperative that clubs have a reliable and knowledgeable partner behind their ATM machines. Not only do we keep our clubs educated — we provide the support, both financially and tech wise, to make sure their machines are up to date and compliant at all times. Beyond maintaining their ATMs, it’s important for clubs to stay on top of trends and make sure they offer their clients the latest technology, and offer their partners more revenue options. For example, use of full-motion video for things like beverage advertising, and offering end users cardless and purchase applications can also bring new revenue streams and new ways for customers to access their cash.

Star Financial

Club owners should make sure the ATM they use is EMV compliant — if not, the customer’s bank may not allow the transaction to be completed due to increased security risk. Star Financial offers the latest EMV-compliant ATM machines.

Cashless payment systems seem to be taking over in several industries; how are your products adapting to this trend? Or are adult nightclubs immune from this trend?

Club Control Systems

Well, only a fool in the club industry would consider going cashless. Servicing over 300 club locations, I have a pretty good idea what cash means monthly to a club.

Now, I do see operating clubs where “ cash value” is added to “in house digital wallet” by the consumer and then allowed to be spent in the club. This doesn’t eliminate cash, but reduces the amount of employees handling cash and speeds up transactions while in the club. Plus a little “breakage” wouldn’t hurt.

BanQone

While we understand that all parts of retail will continue to change as more payment options become available and cost effective, we also believe cash will continue to reign as the king of nightlife entertainment for the foreseeable future partly due to the nostalgic nature that physical cash represents to our industry. The Rain Maker Kiosk is an example of our commitment to helping club owners better manage this reality by using state-of-the-art technology and automation.

Filler Up Financial Services

When it comes to the nightlife industry, especially with us being in Vegas, we still see physical money as the industry standard. Just to touch on a specific example, a new resort opened right on the strip that advertised they were going to be 100% cashless and less than three months after opening, we helped facilitate putting ATMs in through our market partner. The idea sounds amazing but with the extra scrutiny that is specific to nightlife, it’s hard to get everyone on the same page.

National Cash

Though no one is 100% immune to this trend, there is definitely something about the anonymity and the experience of using cash in a adult nightclub. That being said, National Cash is adapting to cardless transactions by using Apple and Google Pay to access cash, possibly using sidecars to create cash in transactions, and even going so far as working with the manufacturer to provide a jukebox and ATM combined in one to save space — different technologies to keep cash relevant and keep it flowing in establishments is key.

Star Financial

Our current clients who own and manage adult nightclubs have told us that their establishments are not necessarily immune but cashless payment systems have not impacted the industry as significantly as other industries such as restaurants, for example.