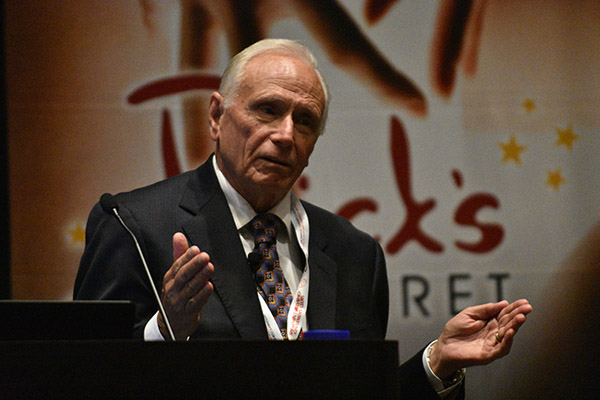

Dan Neistadt of Electronic Merchant Systems presented an EXPO/ED University “Certification Training Seminar” on how to avoid chargebacks, and how to handle one if and when it occurs.

Dan Niestadt told the audience in the seminar room one piece of advice more critical than any other.

Niestadt is the president of Electronic Merchant Systems, has sat on the acquiring committees for Visa and Mastercard, and carries more than 30 years of experience in processing.

On this particular morning, he was presenting the Credit Card “Chargeback” Specialist Certification for the Gentlemen’s Club EXPO. Chargebacks are a cost of doing business with plastic. In that respect, the gentlemen’s club industry is no different than any other industry that accepts credit cards.

And, chances are the reaction is shared as well.

“The first reaction when they have when getting a chargeback is they are upset,” said Niestadt. “That is not going to get you paid. Don’t be your worst enemy.”

Instead, he advises harnessing that anger when presented with a chargeback and turning it into productivity. He points out the central dispute of a chargeback is between you (the club) and the card holder, not the bank.

That starts with gathering all the information that you can surrounding the chargeback. It continues with being truthful if there is a representment, that is the rebuttal of the chargeback itself.

“Remember one thing: you all work or own a business in a legal, lawful industry,” said Neistadt. “So don’t be timid.”

Getting paid

Chargebacks, Neistadt stated, are borne out of either regret or intent. Typically the process starts with the cardholder (disgruntled customer) reaching out to their bank, the bank agreeing and going through the credit card company before the issue arrives at the processing company. The processing company charges the client (you) for the chargeback and then you have opportunity at that point to dispute the chargeback.

“When you do that, a ‘representment,’ you get one chance and one chance only,” Neistadt said. “Put together all the information you have available on that transaction and the person who initiated that transaction, then work with a reputable processor, file your rebuttal and back it goes to the bank. They have an opportunity at that point to either agree with you or agree with the cardholder.”

Neistadt went on to say what has changed in the industry is that in the past, the club’s account would have been charged; when the club sent the representment, the processor would recredit the club.

“Today, that’s changed,” said Neistadt, who says Visa initiated this change with Mastercard soon to follow. “There is no re-crediting. There is only a re-crediting if you win the chargeback. So you lose the money, get the money back and then you have potential of keeping it or losing it.”

“If you don’t read the chip, you will lose. Regardless if it’s the bar serving alcohol or if a customer is going into a private environment, read the chip. The difference between an EMV chip reader and a non-EMV chip reader is $20. If you get a chargeback and you lose it because you didn’t read the chip— I’m sorry, but you only have yourself to kick in the rear end.” – Dan Niestadt

It’s important to keep in mind, Neistadt pointed out, that not all disputes result in a chargeback. Processing companies receive the chargeback notice before you do, so the company will do one of two things — they’ll see if you issued a refund for that chargeback to the customer prior to the chargeback, or simultaneous to the chargeback being filed.

“In that event, we shoot the chargeback back, you don’t get charged, you don’t even know there was a chargeback,” said Neistadt. “The other is perhaps it’s a late chargeback. The chargeback is presented late, at that point we rebut it automatically, send it back to Visa/Mastercard, your account is never charged, you never know you had a chargeback.”

But in the case you do, Neistadt doesn’t see necessarily see a difference between the roots of the chargeback.

“You have the person that walks into your club, the authorized card holder who has made a decision not to pay the bill that night,” he said. “Then you have the person who walks into your club, planning on having a good time and was going to pay but something happens in the club that gives them a reason to dispute that transaction.

“The difference between the two is moot,” Neistadt continues. “The fact is it’s money out of your pocket and you want it back. It gets down to promises made, promises kept. Customers feel they were misled, perhaps by the entertainer, perhaps by the club itself. They’ll look for any reason to charge that transaction back.”

Merchant beware

Oh, that one piece of advice we referenced earlier? Read the chip.

“If you don’t read the chip, you will lose,” warns Neistadt. “Regardless if it’s the bar serving alcohol or if a customer is going into a private environment, read the chip. The difference between an EMV chip reader and a non-EMV chip reader is $20. If you get a chargeback and you lose it because you didn’t read the chip, I’m sorry, but you only have yourself to kick in the rear end.”

For the extra layer of security EMV chips offer, they have brought about a new phenomenon lurking below the surface of obvious charges and fees. Because of the prevalence of chip cards, there are banks that without the cardholder knowing it, will charge a transaction back to the club because the chip wasn’t read.

“They do it automatically,” says Neistadt. “You have to be aware of that. I’m not a card issuer, but I put myself in the mode of a card issuer and if you have a slow-pay customer or a customer who’s always delinquent or a customer who only pays the minimum on every charge and he runs his line up — I would think the card issuers would look at that and they see a big charge for a few thousand bucks, no chip read, they’re going to send it back, even without the customer knowing it. They are a new entrance into the chargeback scenario.”

But no matter the security and the attention to detail, chargebacks are an unfortunate thorn of reality, which is why Neistadt advised the audience to try and work the with cardholder in an attempt to avoid the chargeback.

“Most clubs, depending on the size, will not have a well-trained chargeback person on staff, a person who knows why you’re getting a chargeback, a person who can call the customer and talk to them,” says Neistadt.

This puts the onus back on the clubs. As Neistadt would explain, this means doing all you can to smartly contest any chargeback when it comes to that point; using accurate payment descriptors versus funky pseudonyms, photographic evidence (ID, signatures, etc.) as well as fingerprints where applicable, time-stamping services and turning inebriated customers into cash-only customers.

In the case chargebacks come, do your part and come correct for the representment because there’s only one chance at that. In the event that fails, legal remedies are possible.

“Before you represent a chargeback, know why you were charged,” says Neistadt. “Do you have sufficient evidence? I can tell you in my experience, the more evidence you have, the stronger your case becomes.”

For more information, please visit emscorporate.com or call (800) 318-8083.