The latest battle clubs find themselves waging is among a slew of combatants as businesses clamor for government funding tied to the COVID-19 pandemic.

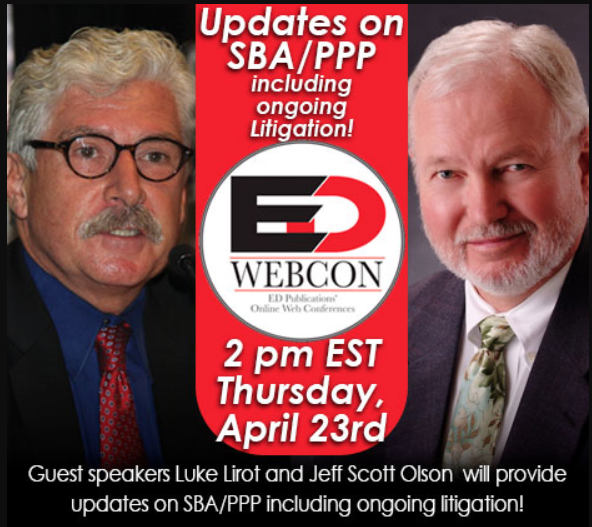

The April 23 ED Webcon on Zoom featured Constitutional attorneys Luke Lirot—a longtime staple of Expos—and Jeff Scott Olson speaking on the Small Business Administration (SBA) and Paycheck Protection Program (PPP) loans being granted to businesses forced to shutter their doors, which includes virtually all gentlemen’s clubs.

No stranger to hardship, clubs have already entered litigation to ensure they get an equal shot at money that could ultimately stave off further hardships.

“As we trudge through the challenges brought on by this pandemic, if nothing else, it certainly has given us an indication of who we can count on,” Lirot said. He introduced Olson as “the only attorney in the country (at the time of the Webcon) who has actually got a positive ruling from the federal court when a lawsuit was filed challenging the denial of the PPP/SBA loan that was in his case informally denied because of the nature of the business.”

Olson advised finding a bank that is quickly processing these loan applications.

“We had a client who tried to get a loan from his own bank and that bank wasn’t a large, national bank, wasn’t actively processing loan applications and wasn’t responding to communications very well,” Olson said. “But this client had an acquaintance who had successfully gotten a loan from a smaller, local bank in the area. He opened a business account with that smaller, local bank and they processed his loan application and funded his loan within a matter of days.

“It’s important to be careful and look for the bank that can help you out,” Olson added. “Not all of them can. Not all of them are adapting as quickly as they ought to be.”

Olson has represented four clients that run Silk Exotic gentlemen’s clubs in Wisconsin. He said his clients filed applications early on for the loans but were informally told they would be denied because of regulations prohibiting lending money to businesses that present live performances of a prurient sexual nature.

At this time, he learned of the ongoing lawsuit over the same principle of a First Amendment violation in the Eastern District of Michigan by attorney Brad Shafer’s firm and worked with it on getting up to speed for his own suit.

“We drew about the best judge I think we probably could have drawn,” said Olson, who filed a motion for a temporary restraining order (TPO) prohibiting the government from enforcing those regulations and required the government to restore the client to their place in the queue had they not been impacted by regulations.

“If the government was making discriminatory decisions because it doesn’t agree with the content of some artist’s message, that would violate the First Amendment.’ We believe that’s exactly what’s happening here.” — Jeff Scott Olson

He expects a preliminary injunction or decision denying the TPO sometime next week.

Olson then explained the government hadn’t submitted anything in writing before the TRO hearing arguing why club denials are appropriate.

“They did make some oral arguments opposing our motion for a temporary restraining order and what they pointed to was a line of US Supreme Court cases that says the government when acting in its role as a patron of the arts, doesn’t have to fund everybody equally,” Olson said.

“When you read those cases, they say ‘If the government was making discriminatory decisions because it doesn’t agree with the content of some artist’s message, that would violate the First Amendment.’ We believe that’s exactly what’s happening here,” adds Olson.

Lirot agrees that any tax-paying club with the requisite licenses and documents should be entitled to the same government assistance as any other business.

“What you’re doing can’t be found to be prurient unless at the point in time there’s a charge of obscenity and you’re convicted of that,” Lirot said. “They can’t make that up out of the blue.”

“I don’t see any limitation on the number of applications you can submit through different lenders/banking institutions. Keep filing them until one hits.” — Luke Lirot

He knows some clubs are getting denied by the banks as opposed to the SBA, which is the arbiter of how the money is divvied up.

“I don’t think (banks) have a lawful basis to be someone to unilaterally decide we’re not eligible for this,” stated Lirot. “Submit the application and let the SBA tell us what they think may or may not make us ineligible.

“The point I’ve been trying to make to the bankers and everybody else that seems to think that all they have to do is look at the general regulations that apply to an SBA loan,” Lirot continued. “It’s not a loan. This is disaster relief that should apply across the board to everyone that pays their taxes. What you’re doing can’t be found to be prurient unless at the point in time there’s a charge of obscenity and you’re convicted of that. They can’t make that up out of the blue.”

Some clients have gotten responses from banks assuming a denial.

“I don’t think (banks) have a lawful basis to be someone to unilaterally decide we’re not eligible for this,” Lirot said. Submit the application and let the SBA tell us what they think may or may not make us ineligible.”

“I don’t think (banks) have a lawful basis to be someone to unilaterally decide we’re not eligible for this,” Lirot said. Submit the application and let the SBA tell us what they think may or may not make us ineligible.”

“The point I’ve been trying to make to the bankers and everybody else that seems to think that all they have to do is look at the general regulations that apply to an SBA loan. It’s not a loan. This is disaster relief that should apply across the board to everyone that pays their taxes.”

Still, knowing some banks will buck, Lirot encouraged clubs to file as many applications as possible.

“You can only sign one contract,” he said. “You can’t get more than one loan, but I don’t see any limitation on the number of applications you can submit through different lenders/banking institutions. Keep filing them until one hits.”

This article briefly summarizes extremely complex legal issues and is provided for general information purposes only and is not intended to provide either an exhaustive analysis of these matters or any specific legal advice or recommendation. Laws vary by state and municipality. Club operators and others are strongly encouraged to consult their own attorneys and accountants for specific advice on how these issues will affect their businesses and what measures to take.

For more information be sure to follow our social media pages, including Facebook and Instagram, visit ExoticDancer.com, and email ED’s Dave Manack at dave@edpublications.com. To reach Luke Lirot, call (727) 536-2100 or email luke2@lirotlaw.com. To reach Jeff Scott Olson, call (608) 283-6001 or email jsolson@scofflaw.com.